Securities and Exchange Commission

The U.S. Securities and Exchange Commission (SEC) should listen to the courts and give up its efforts to block exchange traded funds (ETFs) holding bitcoins, a bipartisan group of lawmakers argued in a letter to SEC Chair Gary Gensler.

The U.S. Securities and Exchange Commission (SEC) isn’t done chasing down crypto exchanges and decentralized finance (DeFi) projects it sees as violating securities laws in the same vein as Coinbase Inc. (COIN) and Binance, said David Hirsch, head of the agency’s Crypto Assets and Cyber Unit.

Securities regulators have complained the exchange is unregistered, and worry about assets being shifted overseas.

While U.S. Securities and Exchange Commission (SEC) Chair Gary Gensler was in the hot seat at a Senate hearing on Tuesday, the most important crypto sentiments may have come from Sen. Sherrod Brown (D-Ohio), who tarred much of the industry as dangerous fraudsters.

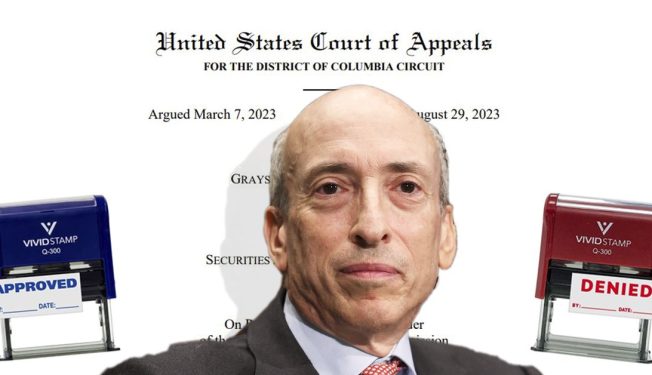

U.S. Securities and Exchange Commission (SEC) Chair Gary Gensler is doubling down on his crypto objections in his first remarks following the second recent court setback in his agency’s sweeping legal fight with the industry.

Whether or not Ripple violated securities law in making XRP available to retail investors by putting it on crypto exchanges is absolutely a question that needs appeals court intervention, the U.S. Securities and Exchange Commission (SEC) argued Friday.

The U.S. watchdog for derivatives markets should create a limited pilot program for regulating cryptocurrencies, said Caroline Pham, one of the members of the Commodity Futures Trading Commission (CFTC).

Sen. Bill Hagerty (R-Tenn.) previewed the lawmaker ire in store for U.S. Securities and Exchange Commission (SEC) Chair Gary Gensler as Congress returns from its summer break, with Hagerty accusing the regulator of stomping on crypto innovation during a speech on Thursday.

The crypto industry’s campaign to set up exchange-traded funds (ETFs) has now pushed the U.S. Securities and Exchange Commission against a wall with Grayscale Investments’ consequential court win, but it’s still up to the agency to decide whether to retreat or keep fighting.

As Coinbase Inc. (COIN) scraps with the U.S. Securities and Exchange Commission (SEC) on its right to exist as an exchange, the company has achieved an unprecedented milestone in U.S. oversight by winning approval to handle customers’ buying and selling of crypto futures.