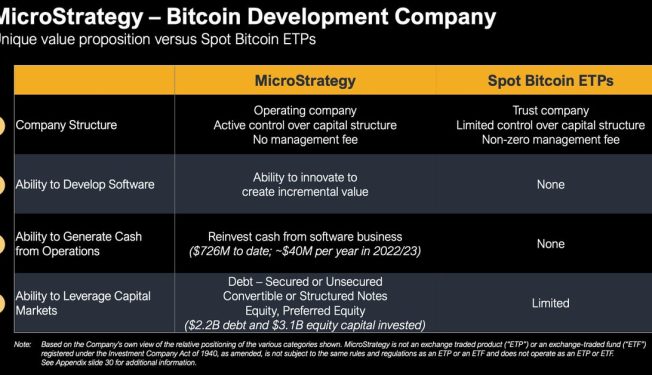

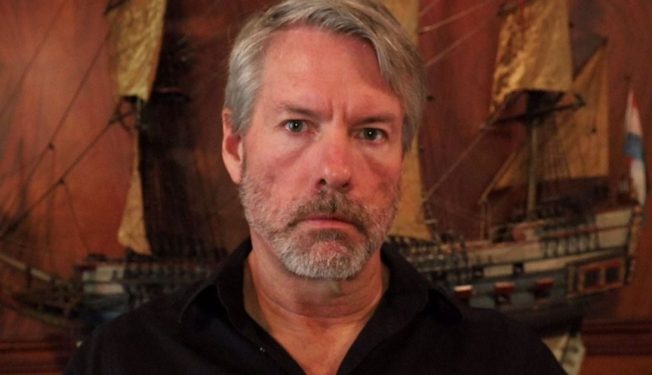

South Korea’s Pension Fund Snaps Up Nearly $34M MicroStrategy Shares

South Korean pension fund, National Pension Service (NPS), has bought MicroStrategy (MSTR) shares worth nearly $34 million in the second quarter of this year, according to filings made public earlier this week.