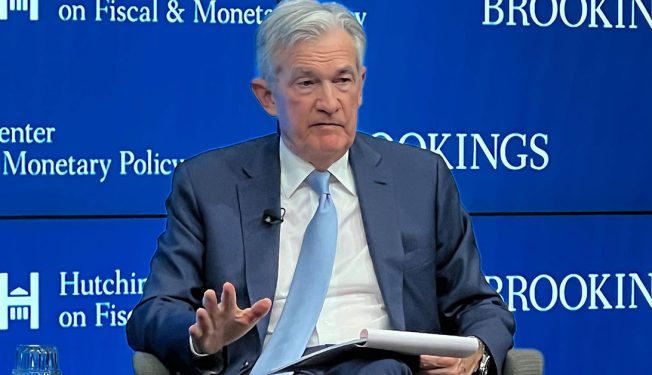

Jerome Powell

Bitcoin Pops Over $61K, XRP Leads Gains Among Majors

Some traders expect market movements nearer to Friday when Federal Reserve chair Jerome Powell is scheduled to speak at the Jackson Hole symposium.

Bitcoin Little-Changed Above $57K as Fed Chair Powell Testifies to Congress

Jerome Powell made clear that central bank policymakers are focused on downside risks to the economy as much as they are inflation.

Cautious Bitcoin Bounce to Face Inflation Data Hurdles Later This Week

The downtrend in inflation has stalled so far this year, putting in doubt the odds for any Fed rate cuts in 2024.

Fed Chair Powell Told House Democrats U.S. Needs Stablecoin Bill: Politico

Powell also said a CBDC would need Congress’ approval before the Federal Reserve will act.

Bitcoin Dips to $42.4K as Fed’s Powell Pours Cold Water on March Rate Cut

Bitcoin dipped to $42,300, while crypto majors ETH, ADA, DOT fell 3%-4% with Solana’s SOL tumbling over 6%.

Fed Leaves Rates Unchanged, Sounds Hawkish Note on March

Bitcoin investors have mostly been focused on spot ETFs and the upcoming halving, but central bank monetary policy is also likely to play a sizable role in the 2024 price outlook.

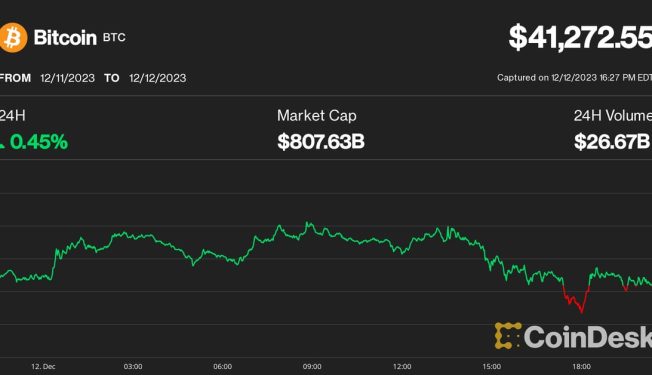

Bitcoin Halts at $41K as Traders Eye Fed Rate Decision; AVAX Flips Dogecoin as Altcoins Jump

Bitcoin remained steady around $41,000 after Monday’s dramatic flush.

Federal Reserve Leaves Rates Unchanged; Bitcoin Flat at $34.5K

Market participants will now turn to Fed Chair Jerome Powell’s post-meeting press conference to glean insight into the future path of U.S. central bank policy.

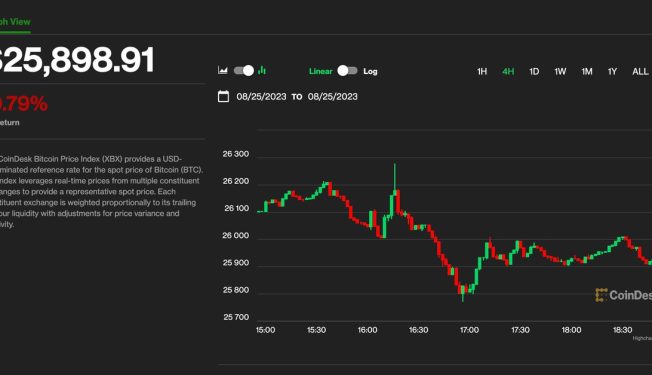

Bitcoin Dips Below $26K, Smaller Cryptos Head Lower on Fed’s Powell’s Hawkish Remarks

Federal Reserve chair Powell speaking at Jackson Hole doubled down on keeping financial conditions tight, including hiking interest rates further if needed.