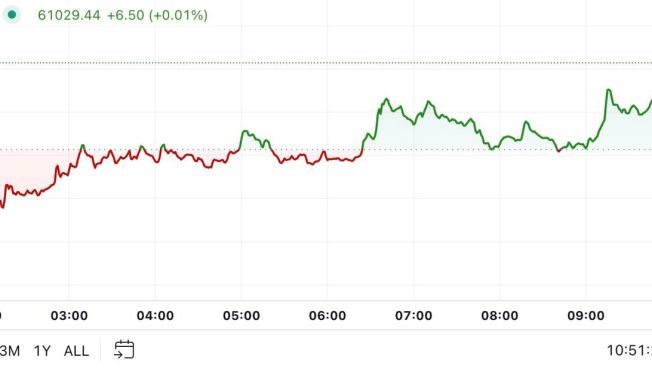

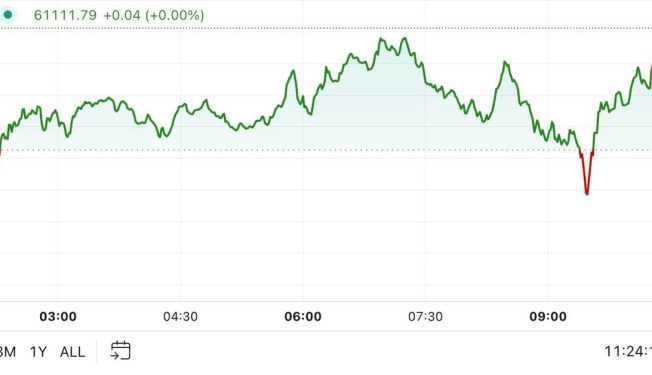

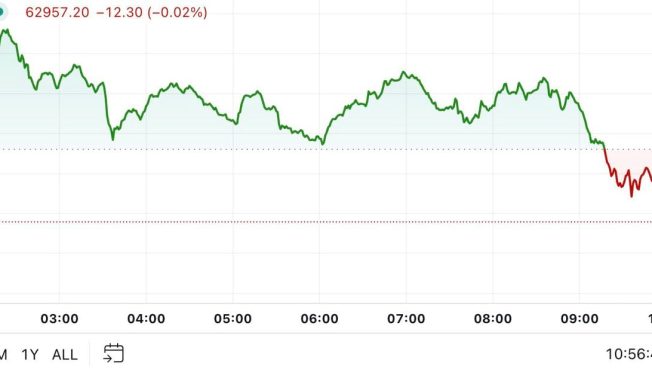

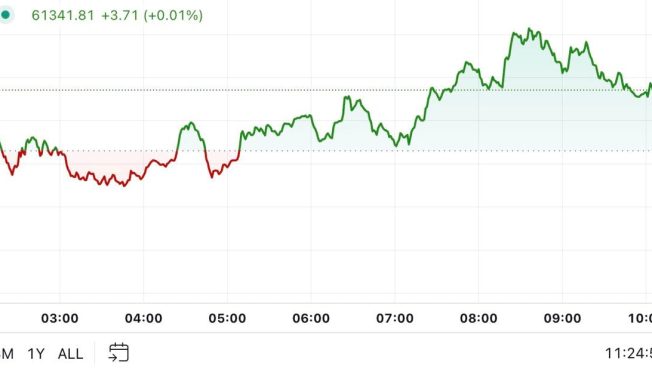

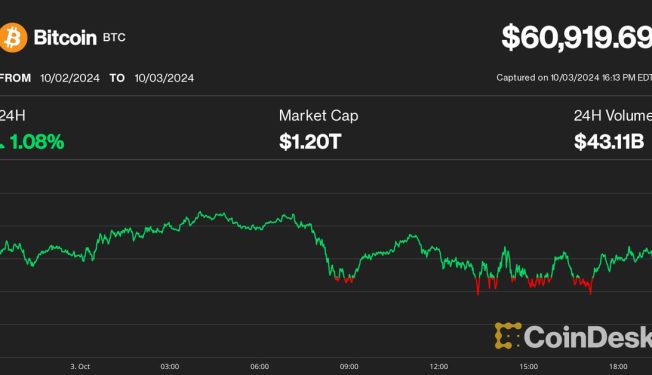

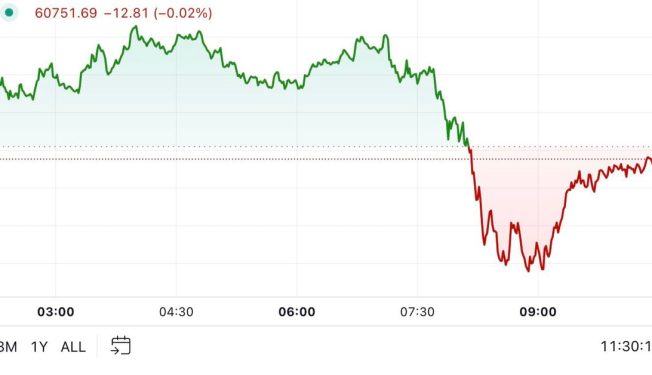

First Mover Americas: Bitcoin Trims Thursday’s Inflation-Led Losses

The latest price moves in bitcoin (BTC) and crypto markets in context for Oct. 11, 2024. First Mover is CoinDesk’s daily newsletter that contextualizes the latest actions in the crypto markets.