Commodity Futures Trading Commission

It would be hard for a big exchange to repeat an FTX collapse if the firm’s internal flow of crypto assets was also reported to an outside repository that U.S. regulators could see. That’s the idea behind new legislation from Rep. Don Beyer (D-Va.) that would force exchanges to share the movement of digital assets now only recorded on their own ledgers.

The Commodity Futures Trading Commission (CFTC) has charged three decentralized finance (DeFi) operations – Opyn, Inc., ZeroEx (0x), Inc. and Deridex, Inc. – with offering illegal derivatives trading, according to a Thursday statement from the agency.

The U.S. watchdog for derivatives markets should create a limited pilot program for regulating cryptocurrencies, said Caroline Pham, one of the members of the Commodity Futures Trading Commission (CFTC).

As Coinbase Inc. (COIN) scraps with the U.S. Securities and Exchange Commission (SEC) on its right to exist as an exchange, the company has achieved an unprecedented milestone in U.S. oversight by winning approval to handle customers’ buying and selling of crypto futures.

Australian officials directly sought out current and former employees of Binance’s operation there this week, demanding copies of internal communications and data from their personal devices, according to a person familiar with the government’s move against the leading crypto exchange, which marked the latest in a pile-up of legal troubles facing the company.

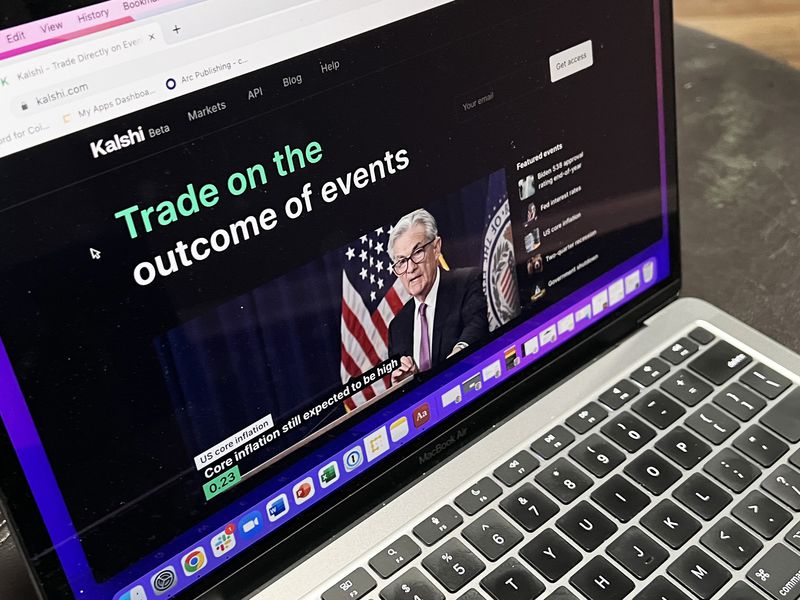

The Commodity Futures Trading Commission will decide on June 26 whether to start a formal 90-day review of prediction market provider KalshiEX’s contract that allows users to bet on which party takes control of the U.S. Congress.

Crypto exchanges would gain a path to registering with the U.S. Securities and Exchange Commission (SEC) and would be able to trade digital securities, commodities and stablecoins all in one place under a proposal from the Republican chairs of the two House of Representatives committees trying to hash out a bill.