Bitcoin ETF

Bitcoin Pushes Towards $36K Ahead of Last Approval Period For Spot ETFs This Year

The Securities and Exchange Commission (SEC) has one last short window, an eight-day period starting Thursday, if it wants to approve all 12 spot bitcoin (BTC) ETF applications this year, Bloomberg analysts wrote in a note on Wednesday.

Hong Kong Now Considering Spot Crypto ETFs for Retail Investors: Bloomberg

The move comes a month after authorities in the City updated financial regulations to allow for retail investors to buy spot crypto ETFs.

What Happens to Bitcoin Price if Spot ETF Isn’t Approved?

Bitcoin’s recent strong performance at least in part is due to optimism regarding the imminent launch of multiple spot ETF products.

Crypto for Advisors: Opinion: Direct Crypto Ownership Is Best

In this week’s issue of Crypto for Advisors, learn why direct ownership of crypto may be in the best interest of the client.

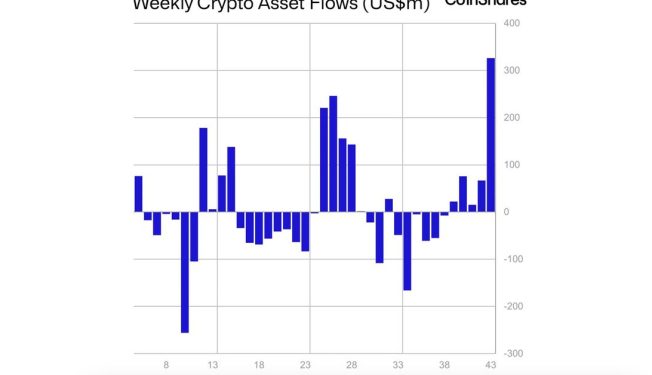

Crypto Funds See Largest Inflow in 15 Months, With Bitcoin, Solana Leading Rally: CoinShares

Ether-based funds continue to fall out of favor, with outflows for the year now totaling $125 million.

Crypto for Advisors: ETH Futures ETFs and What’s Next

Today in Crypto for Advisors Roxanna Islam from VettaFi discusses the current crypto ETF market with a focus on Eth futures performance.

Bitcoin Is Not Gold – Why Spot ETF May Not Be ‘Sell the News’ Event: EY’s Brody

The consulting firm’s global blockchain leader discussed his bullish outlook in a CNBC appearance.

Coinbase’s Grewal Is ‘Quite Hopeful’ That Bitcoin Spot ETFs Will be Approved

Grewal said in a CNBC interview that he is “confident” that after SEC will fulfill its responsibilities in making a decision about the approval of the ETF applications.

Spot Bitcoin ETF Approvals Could Add $1 Trillion to Crypto Market Cap, CryptoQuant Says

Blockchain analytics firm CryptoQuant’s models predict that $155 billion will flow into the bitcoin market cap should the ETFs be approved.