The flexibility of limit orders allows traders to have better control. Minimize their risk while granting them the option of staying away from watching the market constantly. Then on a first-come-first-serve basis. Orders are first ranked by price. Limit orders are only fulfilled if the designated price is reached and, even in that case, execution is not guaranteed, or there’s a chance they can even end up being filled only partially. Therefore, once the price is hit, the order might still not be executed because other previously placed orders of the same amount are waiting to be filled.

The flexibility of limit orders allows traders to have better control. Minimize their risk while granting them the option of staying away from watching the market constantly. Then on a first-come-first-serve basis. Orders are first ranked by price. Limit orders are only fulfilled if the designated price is reached and, even in that case, execution is not guaranteed, or there’s a chance they can even end up being filled only partially. Therefore, once the price is hit, the order might still not be executed because other previously placed orders of the same amount are waiting to be filled.

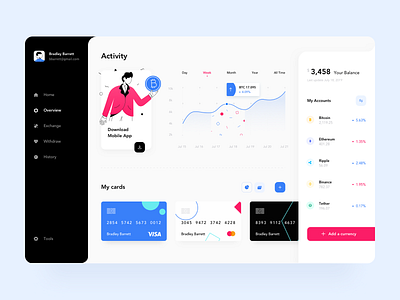

Crypto Trading Fund

Trading cryptocurrencies has become one of the most profitable activities in fintech. It can be very speculative, and knowing what trading tools are available might help investors make better and less risky decisions. After Satoshi Nakamoto launched Bitcoin (BTC) in 2009, there were limited ways to trade the cryptocurrency with fiat currencies or goods. This article gives an overview of different order types in crypto, similar to orders types used in stock trading. Still, they might be employed differently due to the peculiar crypto market structure and conditions. Mostly, trades would happen peer-to-peer (P2P) through the popular Bitcoin forum Bitcointalk.

Trading cryptocurrencies has become one of the most profitable activities in fintech. It can be very speculative, and knowing what trading tools are available might help investors make better and less risky decisions. After Satoshi Nakamoto launched Bitcoin (BTC) in 2009, there were limited ways to trade the cryptocurrency with fiat currencies or goods. This article gives an overview of different order types in crypto, similar to orders types used in stock trading. Still, they might be employed differently due to the peculiar crypto market structure and conditions. Mostly, trades would happen peer-to-peer (P2P) through the popular Bitcoin forum Bitcointalk.

Stop orders would enable traders to choose at which price the order should execute. A market order is an instruction by a trader to buy or sell a cryptocurrency at the best available price in the crypto market and provide instant execution. Crypto market orders are perfect for traders who do not wish to wait for a target price and, unlike all other orders, which are primarily based on the prospect that a price will hit the target, market orders are guaranteed to be fulfilled. Are usually set to minimize losses if the price of an asset drops considerably. Most basic type of crypto order. It is considered the simplest.

Stop orders would enable traders to choose at which price the order should execute. A market order is an instruction by a trader to buy or sell a cryptocurrency at the best available price in the crypto market and provide instant execution. Crypto market orders are perfect for traders who do not wish to wait for a target price and, unlike all other orders, which are primarily based on the prospect that a price will hit the target, market orders are guaranteed to be fulfilled. Are usually set to minimize losses if the price of an asset drops considerably. Most basic type of crypto order. It is considered the simplest.

Remain valid until it’s executed or canceled. Fill or kill (FOC): Unlike the previous IOC order, fill or kill implies that the cryptocurrency order will only be fulfilled if the entire amount can be matched. This type of order allows the trader to allocate a minimum amount available for immediate fill, and any remaining portion that is not filled will be automatically canceled. Immediate or cancel (IOC): Crypto traders can place this order for immediate execution. If it is not instantly filled, it will be automatically canceled and removed from the order book.

Crypto Trading Site

Allocating some funds to the stop-loss order. Also, since a stop-loss order is not guaranteed to be fulfilled entirely when the market order is triggered, stop-loss orders are vulnerable to slippage, just like market orders. Some to other operations might help to prevent this issue. Good ’til canceled (GTC): This cryptocurrency order will be placed on the order book. The time in force instruction defines the length of time a crypto order will remain active before it is executed or expires. What’s the time in force for orders? Setting up an order according to specific time parameters allows traders to be consistent with the cryptocurrency market structures and forecasts, especially if they follow important trading indicators like moving averages which are very time-sensitive.

Cryptocurrency To Trade

For more information in regards to London look into our site.