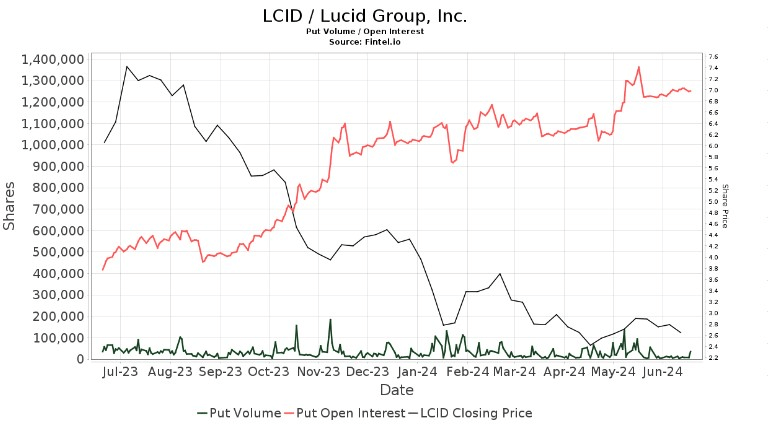

Lucid (NASDAQ: LCID) experienced an exceptionally high level of options trading activity on June 24.

In particular, traders purchased 99,267 put options on LCID stock, a 60% increase from the typical daily volume of 62,053 put options for the EV maker.

This surge in options trading suggests a significant shift in market sentiment towards Lucid stock.

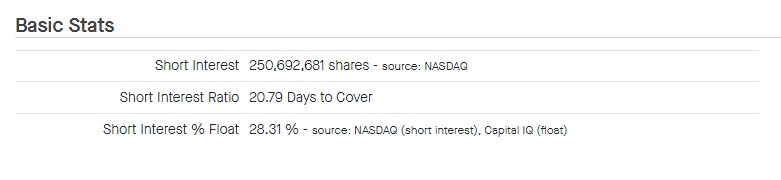

High short-seller activity for LCID stock

According to the most recent data, LCID stock has an exceptionally high short-interest ratio of 28%, with over 250 million shares having an average coverage of 20 days.

Technical analysis of Lucid stock

LCID stock opened trading on June 24 with a positive gain of +$0.055 (2.21%) to see Lucid trade at $2.54, after suffering a drawback of 1.19% in the previous week.

As things stand the technical analysis of Lucid Motors stock reveals that its current support level lies at $2.49, with the next resistance zone identified at $3.35.

Further analysis reveals that LCID shares are trading below their 50,100 and 200-day simple moving averages (SMA), indicating a current downward trend and bearish sentiment.

Lucid Group stock receives strong institutional backing

In recent weeks, Lucid shares have garnered significant interest from hedge funds and institutional investors, the most prominent of which is the Saudi Arabian Investment Fund (PIF), which has signed multiple agreements with the EV maker that have provided much-needed cash injections.

In the first quarter, Meeder Advisory Services Inc. and Norden Group LLC purchased new stakes valued at $29,000 and $32,000, respectively.

Heritage Wealth Advisors increased its holdings by 53.3%, now owning 11,500 shares worth $33,000 after adding 4,000 shares.

Overall, 75.17% of Lucid’s stock is owned by hedge funds and institutional investors, indicating strong institutional support.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

The post Lucid stock faces significant short-seller activity appeared first on Finbold.