Renowned author and educator Robert Kiyosaki, famous for his best-selling personal finance book “Rich Dad Poor Dad,” has reiterated his cautionary stance on the economy, predicting that investors should brace themselves for a potential downturn.

In a post on X (formerly Twitter) on April 7, Kiyosaki warned that traditional financial products such as stocks and bonds are in a bubble and urged investors to take precautions to safeguard their wealth.

With concerns about inflation, mounting debt, and potential market instability, Kiyosaki maintained his advocacy for diversifying investments into safer assets. He specifically mentioned precious metals, including gold, silver, and Bitcoin (BTC).

“The EVERYTHING BUBBLE, stocks, bonds, real estate SET to CRASH. US debt increasing by $1 trillion every 90 days. US BANKRUPT. Save yourself. Please buy more real gold, silver, Bitcoin,” Kiyosaki said.

Kiyosaki’s assets recommendation breakdown

Gold, a traditional hedge against economic uncertainty and currency devaluation, has remained a stable choice for investors over the years. Kiyosaki has been one of the asset’s biggest backers, arguing that it remains a better alternative to products such as the US dollar.

His recommendation about gold comes as the metal has recently enjoyed a renewed rally, breaching several record highs above the $2,000 level.

In this line, several market players foresee opportunity amid the metal’s rising value. Finbold reported that senior commodity strategist for Bloomberg Intelligence Mike McGlone suggested that gold could hit $3,000 per ounce.

Similarly, Kiyosaki also asserts that silver holds potential for future growth, describing the metal as a ‘bargain.’ He believes silver’s potential lies in its ability for utilization in industrial activities.

Meanwhile, Bitcoin has prominently featured in Kiyosaki’s recommended assets, with the investor suggesting that the maiden cryptocurrency could reach the $100,000 milestone in 2024.

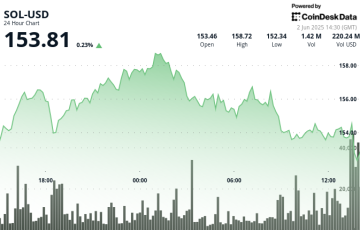

At the moment, Bitcoin is striving to surpass the $70,000 mark, having recently achieved new all-time highs above this threshold.

Indeed, bullish sentiments surround the asset, particularly with the forthcoming halving. Consequently, according to a Finbold report, some analysts anticipate that Bitcoin will maintain its bullish trajectory and enter into an aggressive cycle.

The post R. Kiyosaki names 3 assets to save you from the ‘everything bubble’ appeared first on Finbold.