The AI boom has transformed the industry, prompting companies to modernize and incorporate new technologies into their operations quickly. As a result, semiconductor stocks, such as Nvidia (NASDAQ: NVDA) and Super Micro Computer (NASDAQ: SMCI), have experienced significant increases in value.

While Advanced Micro Devices (NASDAQ: AMD) may appear to be a late bloomer, its consistent and robust progress, backed by technical and fundamental indicators, sets the stage for substantial growth over the next decade.

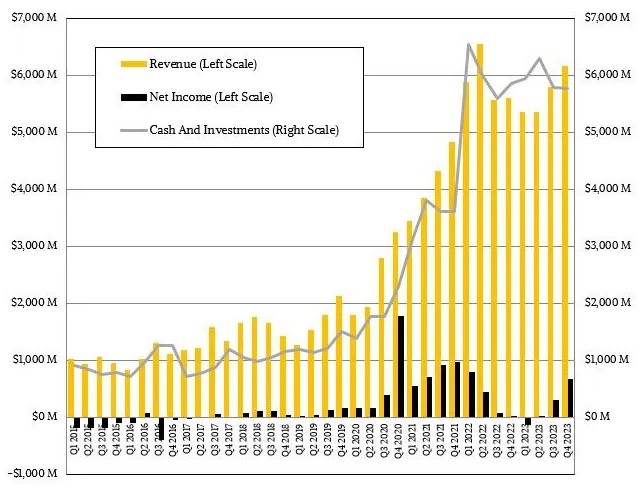

Finbold analyzed the current market dynamics, AMD’s operations, and revenue to assess the potential for this stock’s future gains.

Approaching AI from different angles

Despite the market’s emphasis on AI being confined to GPU sales, AMD’s diverse business segments serve as effective channels for distributing its core AI technology. This distribution advantage is expected to contribute to improved unit economics for AMD in the foreseeable future.

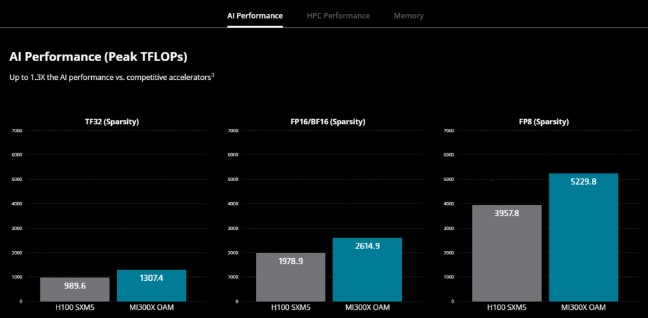

As AI extends beyond GPUs to encompass all computing platforms, AMD’s expertise in chipsets uniquely positions it to integrate AI capabilities across its product line. This strategic approach goes beyond competing solely in GPU sales with NVDA and sets AMD up for sustained success across multiple segments.

By diversifying AI integration efforts and leveraging chipset-based GPUs with differentiated price-to-performance ratios, AMD stands to gain market share from Nvidia while expanding its presence in AI-powered computing devices, among other potential opportunities.

Low-cost manufacturing is an advantage

Regarding manufacturing, AMD can pursue both initiatives at minimal cost due to its competitive advantage from its chipset platform. This platform can be applied across various product lineups and beyond, providing a generalized solution.

AMD already possesses a distribution channel within the PC (CPU) domain. Therefore, even if the company does not capture market share from NVDA, it can still achieve a significant return on its AI investment through PCs.

Personalization as a distinct feature

In addition to AI, the trajectory of computing is shifting towards personalization.

As companies seek customized computing solutions tailored to their specific requirements, AMD stands out as the sole entity currently positioned to meet these demands effectively.

Furthermore, other industry players like Intel (NASDAQ: INTC) and NVDA will likely need to transition to chipset architectures over time. This move is necessary to remain competitive in the AI sector and develop a platform capable of delivering personalized computing solutions.

In conclusion, the unique approach that AMD has undertaken may take more time but provides multiple diversified approaches to success, something seasoned investors prefer when looking for their next portfolio additions.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

The post AMD value could increase by 20x in the next decade appeared first on Finbold.