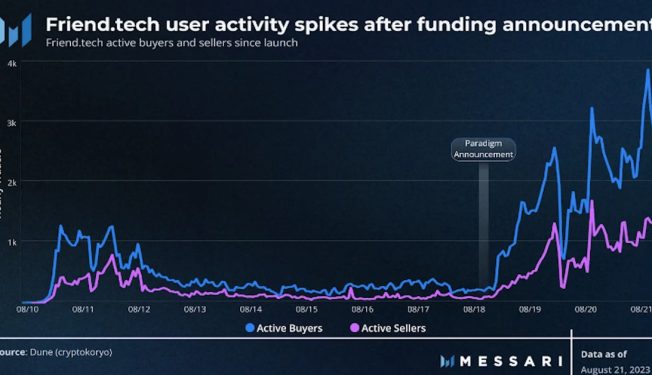

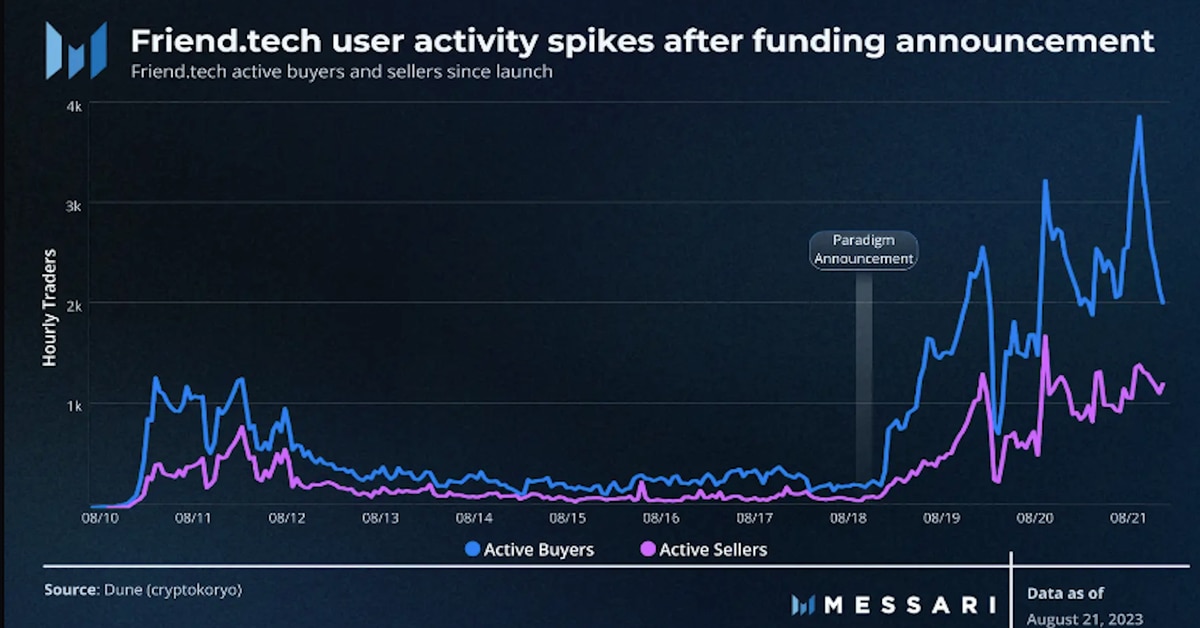

PRICE OF POPULARITY: Coinbase, the big U.S. crypto exchange, is getting a fast education, as one of the first big publicly traded companies to run its own blockchain. Its new Base project, a layer-2 network atop Ethereum, just launched this month, and already one of its new applications, Friend.tech, has gone viral, quickly attracting more than 100,000 users and generating more than $25 million in fees. Friend.tech, which allows users to purchase shares of X (Twitter) influencers, saw a rapid spike in activity (see chart above) after announcing on Aug. 18 that it had scored seed funding earlier this year from the crypto-focused venture-capital firm Paradigm. Friend.tech’s early success has helped drive up key metrics on the Base network, driving its total value locked (TVL) past $200 million and at one point pushing transactions per second above those of Ethereum as well as rival layer-2 projects Arbitrum and Optimism. According to FundStrat, Base has accrued nearly $4 million in fees, $2.5 million of which is retained by Coinbase; it works out to $30 million extra revenue on an annual basis. One question is whether Base can retain the growth once this hot ball of money bounces to the next crypto craze. “Friend.Tech’s speculative nature,” writes Galaxy Research, “highlights ongoing questions over Coinbase’s role in moderating a chain that today is ‘decentralized’ in name only.”